SV-STROY JSC

The large construction company operating in multiple cities with a distributed network of offices.

The Challenge

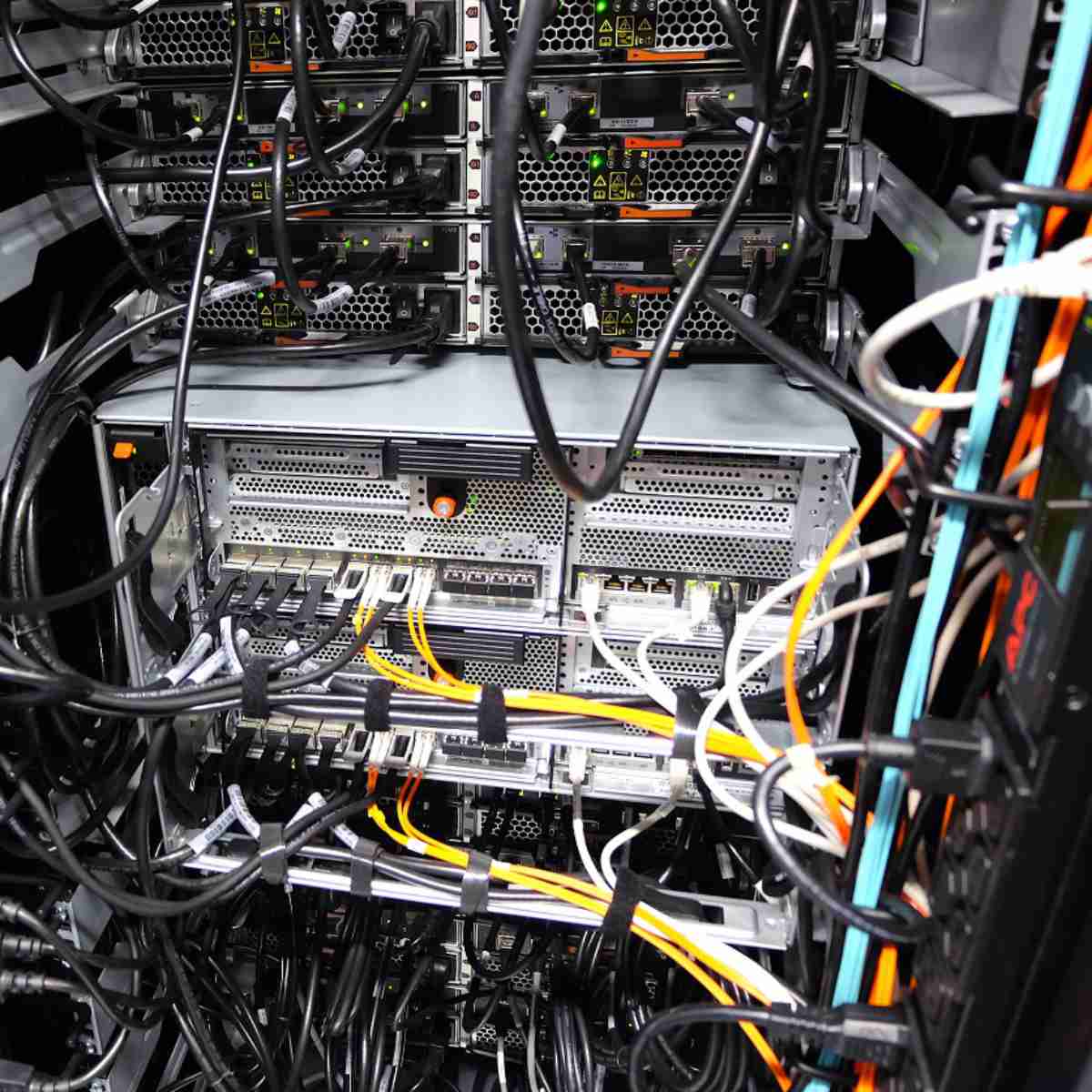

Our client operated a distributed network of enterprises across multiple cities and required a highly reliable and fault-tolerant data processing solution. The challenge was to design and implement a centralized server infrastructure that could seamlessly integrate all locations, ensure uninterrupted operations, and maintain high availability even in the face of power outages or network failures.

Our Approach

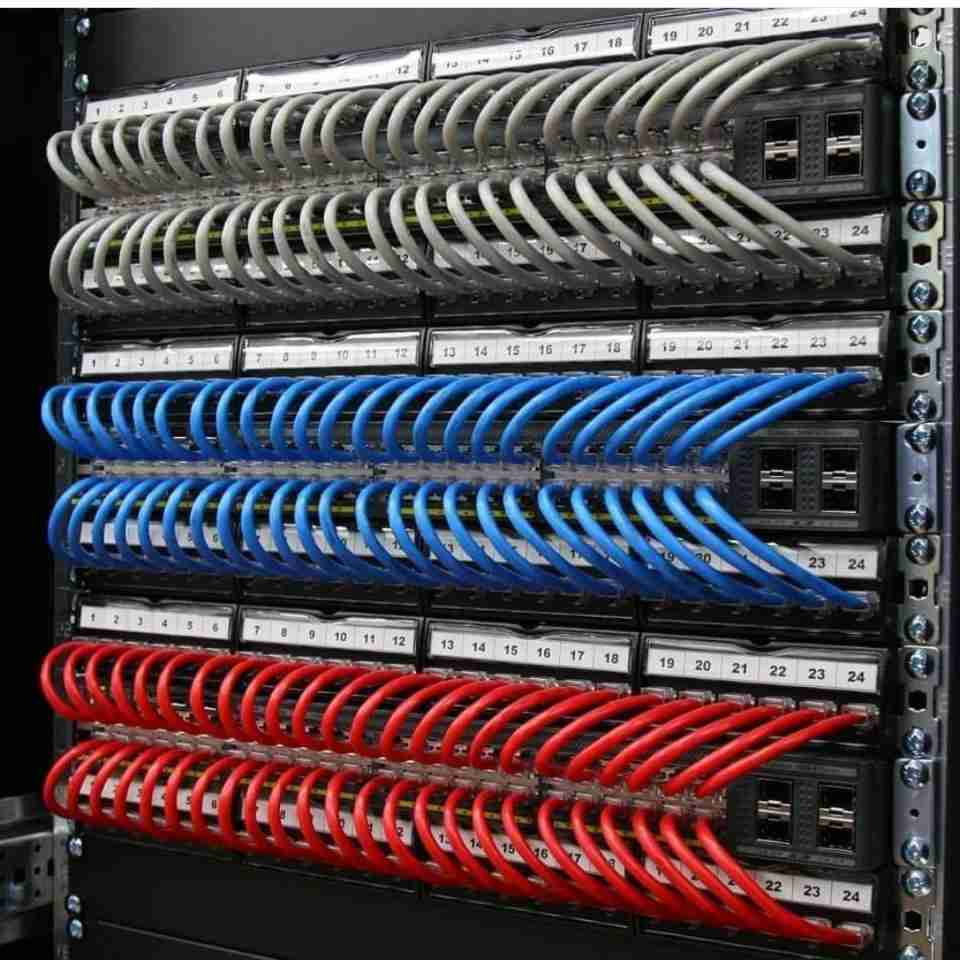

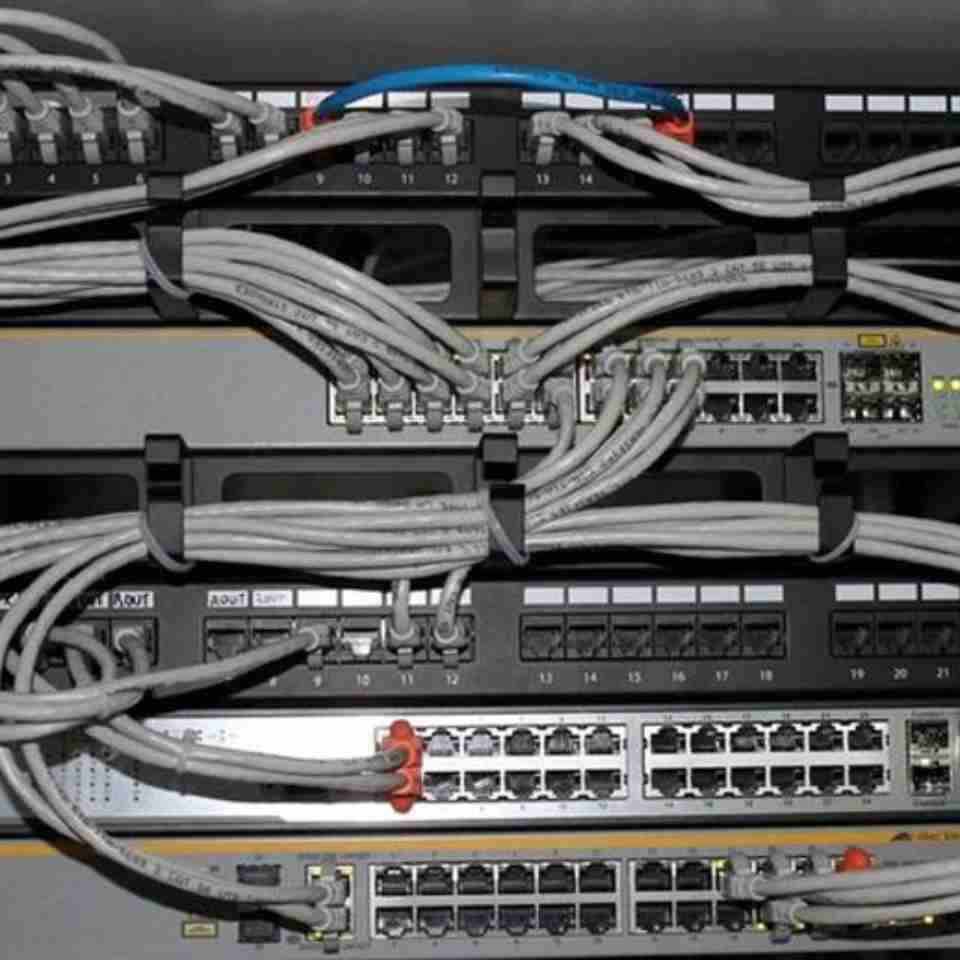

We took a comprehensive approach to designing a modern data processing center. Our team focused on creating a robust server infrastructure that would serve as the central hub for data collection and processing. We prioritized redundancy in power supply, cooling, and connectivity to ensure continuous operation, even under extreme conditions.

The Solution

We have successfully created a fail-safe hardware and software complex tailored to the client's needs.

- A state-of-the-art server room to centralize and process operational data.

- Uninterruptible power supply (UPS) systems and backup generators to guarantee power availability.

- Advanced climate control and precision air conditioning for optimal temperature and humidity regulation.

- Redundant communication channels to prevent downtime in case of network disruptions.

Results & Impact

-

As a result of our solution, the client now benefits from a highly secure, reliable, and efficient data processing center. The infrastructure ensures uninterrupted operations, minimizes data loss risks, and supports seamless communication between multiple locations. This robust system significantly enhances the client's ability to manage and process data across its distributed network, leading to improved operational efficiency and business continuity.